Contents

Networks that support crypto staking typically allow people who own tokens to provide them for other users to deploy in validating transactions, thereby earning a share of the rewards. However, there are some considerations and risks to take into account before staking, including market price movements, lock-up periods, fees, and validator penalties. It doesn’t only benefit the blockchain systems but also investors. You and many other parties grant some coins to a blockchain network. And, the blockchain network selects one of the parties as a validator to confirm the transactions. Once the validator successfully confirms it, they are rewarded with some new crypto coins.

Banks lend out your deposits, and you earn interest on your account balance. Although crypto that you stake is still yours, you need to unstake it before you can trade it again. It’s important to find out if there’s a minimum lockup period and how long the unstaking process takes so you don’t get any unwelcome surprises. For example, many smaller crypto projects offer high rates to entice investors, but their prices then end up crashing. If you’re interested in adding crypto to your portfolio but you’d prefer less risk, you may want to opt for cryptocurrency stocks instead.

Simply by holding on to your tokens/coins in a secure place and you will begin earning money. Staking is the process of locking your crypto to secure the blockchain network. This is the big one — increasing your individual stash of tokens or coins.

You can earn interest by staking popular stablecoins such as Tether and USD Coin . Users can participate and earn a myriad of types of rewards with their cryptocurrency on KuCoin. The interest-bearing rewards range from being accrued from promotions, savings or stakings, which are all a part of KuCoin Earn. The fixed interest available on Ethereum 2.0is nearly 4.7% annually. Crypto staking can involve committing your assets for a set period of time during which you might not be able to sell or trade them. If you think you might move your crypto on short notice, make sure you look at the terms carefully before staking it.

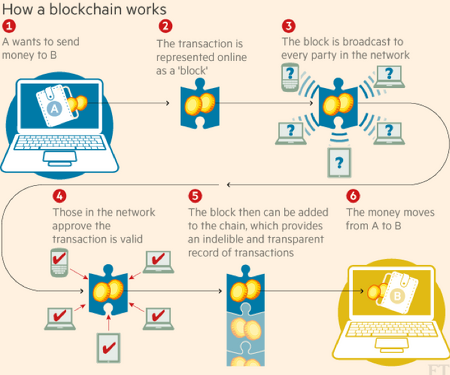

However, few networks utilize a dual-token system that pays rewards in the way of another token. In staking of rewards, you are allowed to put your crypto-assets on the line by using an underlying proof of Stake node to confirm the block of transaction. If the node that you delegated successfully signs or attests to blocks you will be rewarded for staking which will increase your crypto-assets net. One of the ways Proof of Stake lowers costs is by not mandating miners to work through math-related problems that consume energy. The transactions instead are verified by those who are committed to the blockchain through the process of staking.

To stake your crypto requires a validator node, and he should be aware of how to process the staking process with 100% accuracy to get good returns. There are some stakable assets in crypto that have a lock-up period. Which means, if you lock your asset for a period of time, you can’t unlock it until the period is over. Has become one of the best ways for investors to earn a good amount as an interest on their stakes.

Ways of Staking Cryptocurrency

Your first decision will be whether to actually validate transactions using your own computer or to “delegate” your cryptocurrency to someone who’s doing that legwork for you. Staking is a way of preventing fraud and errors in this process. Users proposing a new block — or voting to accept a proposed block — put some of their own cryptocurrency on the line, which incentivizes https://coinbreakingnews.info/ playing by the rules. Passive income, and it can be seen as the crypto world’s equivalent of earning interest or dividends while holding onto your underlying assets. The purpose of this website is solely to display information regarding the products and services available on the Crypto.com App. It is not intended to offer access to any of such products and services.

Yes, the validator may also create a risk–if he makes any mistake. Staking uses a mechanism that causes very little energy, ultimately helping the environment. It doesn’t require high computational power, which makes it much better than crypto mining. High interest in your crypto stake is given to you in return as a reward. Staking is optimal for those who plan to hold their asset for the long term regardless of the price swings.

It’s an easy way to earn interest on your cryptocurrency holdings. Offers a wide selection of cryptocurrencies eligible to earn interest income. There are a few questions to ask before making a decision about whether to stake your crypto.

Difference between staking and lending

You can buy, swap, and stake through Ledger Live with our partners. This is offered to our VIP users and Market Making participants. Download Q.ai today for access to AI-powered investment strategies. Since the crypto markets are so volatile, harnessing the power of artificial intelligence is especially attractive.

It’s worth noting that if the stakeholder moves their coins out of cold storage, they’ll stop receiving rewards. The main idea is that participants can lock coins (their “stake”), and at particular intervals, the protocol randomly assigns the right to one of them to validate the next block. Typically, the probability of being chosen is proportional to the amount of coins – the more coins locked up, the higher the chances. Staking crypto may not always be profitable, so it is important to do your own research and understand all the risks involved before getting started. With careful planning and patience, however, you can maximize your staking returns and help contribute to the success of these distributed networks. Last, staking, like any cryptocurrency investment, carries a high risk of losses.

In other words, a major bear market has hit crypto investors hard. As long-term investors know, bear markets are a natural part of the business cycle. While the crypto winter might be particularly difficult to watch for crypto enthusiasts, there are still ways to earn extra money through your crypto portfolio. As mentioned, stakers are more entrenched in a specific ecosystem or blockchain network, which may give them more clout as to what happens next with a specific cryptocurrency. “It’s similar to owning stock in a company. By staking, you’re getting voting rights,” says Welch. Staking is the process of delegating or locking up crypto holdings to earn rewards.

- “People often delegate to validators with lower voting power to increase the decentralization of an ecosystem,” Bhat says.

- If you’re interested in staking your crypto coins or tokens to support a popular blockchain network, there are a few things you need to do first.

- Staking can require that you lock up your coins for a minimum amount of time.

- Staking can yield rewards that are higher than what you can make from savings accounts.

- In some cases, we receive a commission from our partners, however, our opinions are our own.

This also makes it a more scalable option that can handle greater numbers of transactions. I’m the deputy editor of Investing & Retirement at Forbes Advisor. I’m pretty familiar with the investing beat, having served as the former assistant managing editor of Investing at U.S. News & World Report, where I also launched several newsletter products. My work has appeared in TheStreet, Mansion Global, CNN, CNN Money, DNAInfo, Yahoo Finance, MSN Money, and the New York Daily News.

This varies greatly from pool to pool, and blockchain to blockchain. According to data, the average staking reward rate of the top 261 staked assets surpasses 11% annual yield. It’s important to note, though, that rewards can change over time. Cryptocurrency comes with numerous advantages, like the opportunity to earn money passively and contribute to networks.

Staking can be a way to passively receive rewards on cryptocurrency holdings. Some typical ways to participate in staking are to become a validator for a PoS blockchain, join a staking pool, or use a staking service offered by crypto exchanges. Each staking coin offers different benefits, so it’s important to compare the features of each one before making a decision. Additionally, some staking coins may be more volatile than others, so it’s important to understand the risks involved before investing.

Staking is a way to put your crypto to work and earn rewards on it.

Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance. Due to that, it’s highly recommended to do good research on whatever cryptocurrency decides to invest in. Ethereum hasn’t adopted the proof of stake model fully as the developers are working on it. But still, they are offering the staking process, which is good news for Ethereum lovers. That’s why it’s recommended to stake your crypto in an asset without a lockup period.

However, some commonly cited contenders for this title include Bitcoin, Ethereum, Ripple, Litecoin, NEO, EOS, IOTA, Cardano, Monero, and Stellar. These cryptocurrencies offer a range of features and benefits to users and investors alike and have played an important role in shaping the current state of the blockchain industry. Additionally, many of these projects are actively working on developing new technologies or improving existing protocols to make them more efficient or scalable. Cryptocurrencies are also extremely volatile investments, where double-digit price swings are common during market crashes.

As market changes happen, Q.ai will automatically make the necessary adjustments to your portfolio to keep your holdings in line with your goals and risk tolerance. And in 2022, the popularity of both decentralized and centralized staking appears to be at an all-time high as DeFi staking continues to flourish. As the name suggests, the platform is used in the issuance of synthetic assets, commonly known as Synths. Synths are virtual assets used to represent physical and real assets such as stocks, cryptos, and fiat. And since this is public information, it might incentivize more participants to get involved in staking.

The three levels depict the staking charges.For example, Basic users pay as little as $1, while those on the Power Max plan pay more than $10 per month. The platform accommodates the staking of more than 50 cryptocurrencies with on-chain staking support. Trust Wallet – The versatile Trust Wallet is a private wallet supported by Binance. The wallet allows users to earn a passive income by staking XTZ, ATOM, VeChain , TRX, IoTeX , ALGO, TomoChain and Callisto .

These alternatives also offer ETH holders an opportunity to stake without the hassle of setting up and maintaining a validator node. There are some variations as to how PoS systems work depending on which protocol, but generally, the algorithm chooses blocks at random and assigns them to a validator node for review. If everything is accurate, the validator adds the block to the ledger and receives the block rewards and transaction fees. However, if a validator adds a block with the wrong data, its staked holdings will be penalized.

Still, since you’re selling on a secondary market, you need to find a willing buyer or lender. Plus, there’s no guarantee you’ll be able to do so or get all your money back early. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. Lyle Daly has positions in Bitcoin, Cardano, Ethereum, Polkadot, and Solana. The Motley Fool has positions in and recommends Bitcoin, Cardano, Ethereum, and Solana.

What Are The Benefits of Staking Crypto

Stakers aren’t guaranteed anything, as the process of forging new blocks and doling out rewards is randomized, but stakers do “earn interest,” so to speak, by staking. Polkadot uses nominated proof-of-stake as its consensus algorithm, where nominators back multiple validators that they deem to be of good behavior with their stake. Both types of network participants lock their tokens as collateral and earn staking rewards for their contribution.

Are my staking rewards taxable income?

You may obtain access to such products and services on the Crypto.com App. Past performance is not a guarantee or predictor of future performance. The value of crypto assets can increase or decrease, and you could lose all or a substantial amount of your purchase price. When assessing a crypto asset, it’s essential for you to do your research and due diligence to make the best possible judgement, as any purchases shall be your sole responsibility.

Whether you are new to staking or an experienced crypto investor, there are many things to consider when deciding if staking is right for you. Ultimately, the decision will depend on your individual goals and preferences as well as the specific details of the staking platform or network that you choose. So if you’re thinking about staking crypto, be sure to do your research and take the time to make an informed decision that aligns with your needs and goals. A proof of stake system is a type of consensus algorithm that helps secure a blockchain network. In a PoS system, stakers can validate transactions and earn rewards for their participation. This process helps to secure the network and incentivizes stakers to support its continued development.